Combat SIM-related fraud and save costs with face biometrics

Hi, [First name] Would you like to streamline and secure your client's pre- and post-paid customer journeys? As a [Job Title], we know you're looking for an innovative solution to help Telkom prevent SIM swap fraud and accurately collect and segment prepaid customer data. We can help you reduce friction, protect against fraud, and save costs.

[First Name], Fill in our Form!

Fit For Financial Institutions

2024 Biometric Digital Identity Financial Services Prism Report

Learn how iiDENTIFii's IDV solutions improve security and user experience. Download the 2024 Financial Services Prism Report for insights.

Through streamlining and securing their pre- and post-paid customer journeys, telcos can prevent SIM swap fraud and accurately collect and segment prepaid customer data, leading to reduced friction, fraud protection and cost savings.

Want to learn how to leverage enterprise-grade biometrics?

iiDENTIFii is trusted by:

How can you trust that a person is who they say they are? With identity fraud growing exponentially, this question requires an urgent response and strategy. iiDENTIFii’s remote biometric identity solution makes safe verification and onboarding possible for financial institutions and their customers. The financial sector has a duty of care to protect consumers from fraud. This means having the right processes in place to protect financial assets. The top banks in Southern Africa trust us to meet their identity verification requirements - shouldn’t you?

Benefits of implementing iiDENTIFii Face Authentication for Financial Institutions

Secure remote identity you can trust.

|

Patented 4D Liveness® Technology |

|

Biometric Privacy |

|

|

Enterprise-grade Identity Solution |

|

|

African Face Accuracy |

|

|

Customer-friendly |

|

|

Government Trusted |

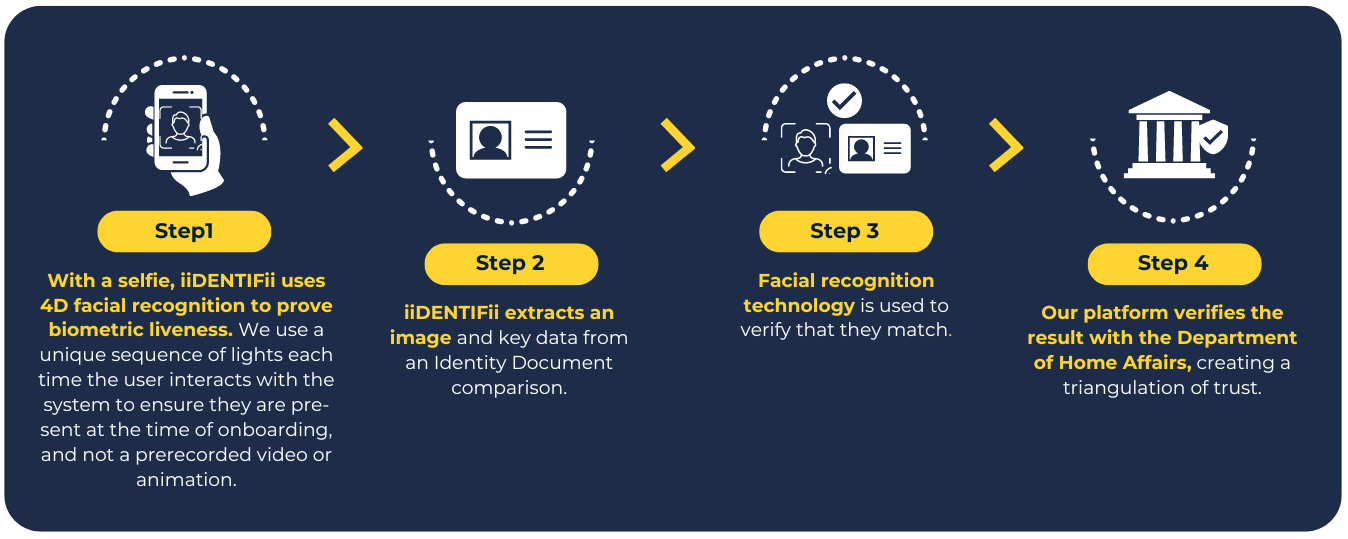

iiDENTIFii’s biometric authentication system uses a four-dimensional liveness and identity verification process.

This ensures that the person using the system is who they say they are, is present, and that a replicated video or animated photo is not being used. Financial institutions have proven this process to reduce fraud and financial crime.

Face biometrics will ensure that you can secure the identity of your stakeholders and customers, protecting your financial institution from cyber fraud. With an inclusive, enterprise-grade solution, iiDENTIFii is the IDV of choice for Africa’s leading financial institutions.

Customer

Call Centre agent diverts custimer to Tobi Chatbot

Tobi Chatbot requests a selfie via back-end integration with iiDENTIFii

iiDENTIFii

integration with HANIS for verification

.png?width=100&height=96&name=a6f5a34c-69fe-4793-b2a5-964c16ff6c47%20(2).png)

Customer FRICA™ 'ed via HANIS

Customer

More efficient, more secure, and more inclusive financial institutions in Africa

Choose iiDENTIFii for:

- Inclusive, stress-tested algorithms

- Patented 4D Liveness® technology

- Seamless mobile and web-based platforms

- The identity verification provider of choice for Africa’s leading financial institutions

![CA-2024-03-01- MTN [Smart]-telco guy 2 CA-2024-03-01- MTN [Smart]-telco guy 2](https://connect.iidentifii.com/hs-fs/hubfs/CA-2024-03-01-%20MTN%20%5BSmart%5D-telco%20guy%202.png?width=1000&height=1009&name=CA-2024-03-01-%20MTN%20%5BSmart%5D-telco%20guy%202.png)

.png?width=400&height=400&name=V3%20(2).png)